boise idaho sales tax rate 2019

Plus 6625 of the amount over. The sales tax jurisdiction name is Boise Auditorium District Sp which may refer to a local government division.

Claim Your Grocery Credit Refund Even If You Don T Earn Enough To File Income Taxes Idaho Bigcountrynewsconnection Com

Blackfoot ID Sales Tax Rate.

. This information is for general guidance only. You can print a 6 sales tax table here. The average local rate is 003.

Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3. Even with these tax cuts that remains on the higher side of all the rates in the country. Prescription Drugs are exempt from the Idaho sales tax.

Boise County collects on average 056 of a propertys assessed fair market value as property tax. For tax rates in other cities see Idaho sales taxes by city and county. Like the Federal Income Tax Idahos income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

4 rows The current total local sales tax rate in Boise ID is 6000. Average Sales Tax With Local. Tax laws are complex and change regularly.

Depending on local municipalities the total tax rate can be as high as 9. This can only increase each year by up to 3 plus growth. Plus 3625 of the amount over.

The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. Learn more about local sales tax for cities. Please contact the Tax Reporting Department for the appropriate procedures if you are making sales to locations in Washington.

Does Idaho have sales tax on cars. Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85. The average combined tax rate is 603 ranking 37th in the.

Tax rates rules and depositing procedures are different than those applicable to Idaho sales. Last updated November 14 2019. This guide is for individuals leasing companies nonprofit organizations or any other type of business that isnt a motor vehicle dealer registered in Idaho.

31 rows Ammon ID Sales Tax Rate. There are a total of 124 local tax jurisdictions across the state collecting an average local tax of 0044. Boise County collects on average 056 of a propertys assessed fair market value as property tax.

The average yearly property tax paid by Boise County residents amounts to about 189 of their. For tax rates in other cities see Idaho sales taxes by city and county. The minimum combined 2022 sales tax rate for Boise Idaho is.

Idaho Code Title 50 Chapter 10. Boise County Idaho Property Taxes - 2022. A levy rate of 014 rounded to three decimals means you owe 14 of taxes for every 1000 of your propertys taxable value.

15 lower than the maximum sales tax in OK. Idaho collects a 6 state sales tax rate on the. It explains sales and use tax requirements for those who buy or receive a.

6 Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3. Contents1 Do Oregonians pay sales tax in other states2 Do Oregonians pay car sales tax in Idaho3 Does Idaho. Idaho has 12 special sales tax jurisdictions with local sales taxes in addition to the state sales.

Tax Rate Based on State of Residence In our area here in the Boise area sales tax is six percent but if we sell to an Oregon resident they dont have to pay Idaho sales tax. Plus 3125 of the amount over. In the 2018 tax-year the property taxes collected across Idaho increased by 64 marking the highest increase in taxes paid in a decade.

In Ada County property taxes will account for 47 of the countys 2019 budget a budget that has seen a 27 increase in the last 4 years alone. The 6 sales tax rate in Boise consists of 6 Idaho state sales tax. The Idaho sales tax rate is currently.

Idahos maximum marginal income tax rate is the 1st highest in the United States ranking directly. The 6 sales tax rate in Viola consists of 6 Idaho state sales tax. Property 7 days ago The median property tax in Boise County Idaho is 1044 per year for a home worth the median value of 186700.

Voter Approved fund tracker 2020 INFORMATION AND DATES TO REMEMBER The next tax deed sale will be September 2023. Idaho collects a state income tax at a maximum marginal tax rate of spread across tax brackets. There is no applicable county tax city tax or special tax.

Levy Rates Voter Approved Fund Tracker 2021. Levy rates for 2019 in Boise were at their lowest levels in at least 10 years. Last full review of page January 27 2016.

There is no applicable county tax city tax or special tax. Rising Tax Rates. You can print a 95 sales tax table here.

Idaho State Tax Commission PO Box 56 Boise ID 83756-0056 If youre mailing a payment without a return send your payment with Form ID-VP to. The County sales tax rate is. For tax rates in other cities see Oklahoma sales taxes by city and county.

This guidance may not apply to your situation. This is the total of state county and city sales tax rates. While taxing districts set their levy rate.

We cant cover every circumstance in our guides. Boise State University is responsible for collecting and remitting sales tax to the State of Washington. The sales tax jurisdiction name is Latah which may refer to a local government division.

Idaho State Tax Commission PO Box 83784 Boise ID 83707-3784 If youre sending your return using a delivery service that requires a physical address use the following. The Boise sales tax rate is. 278 rows Idaho Sales Tax.

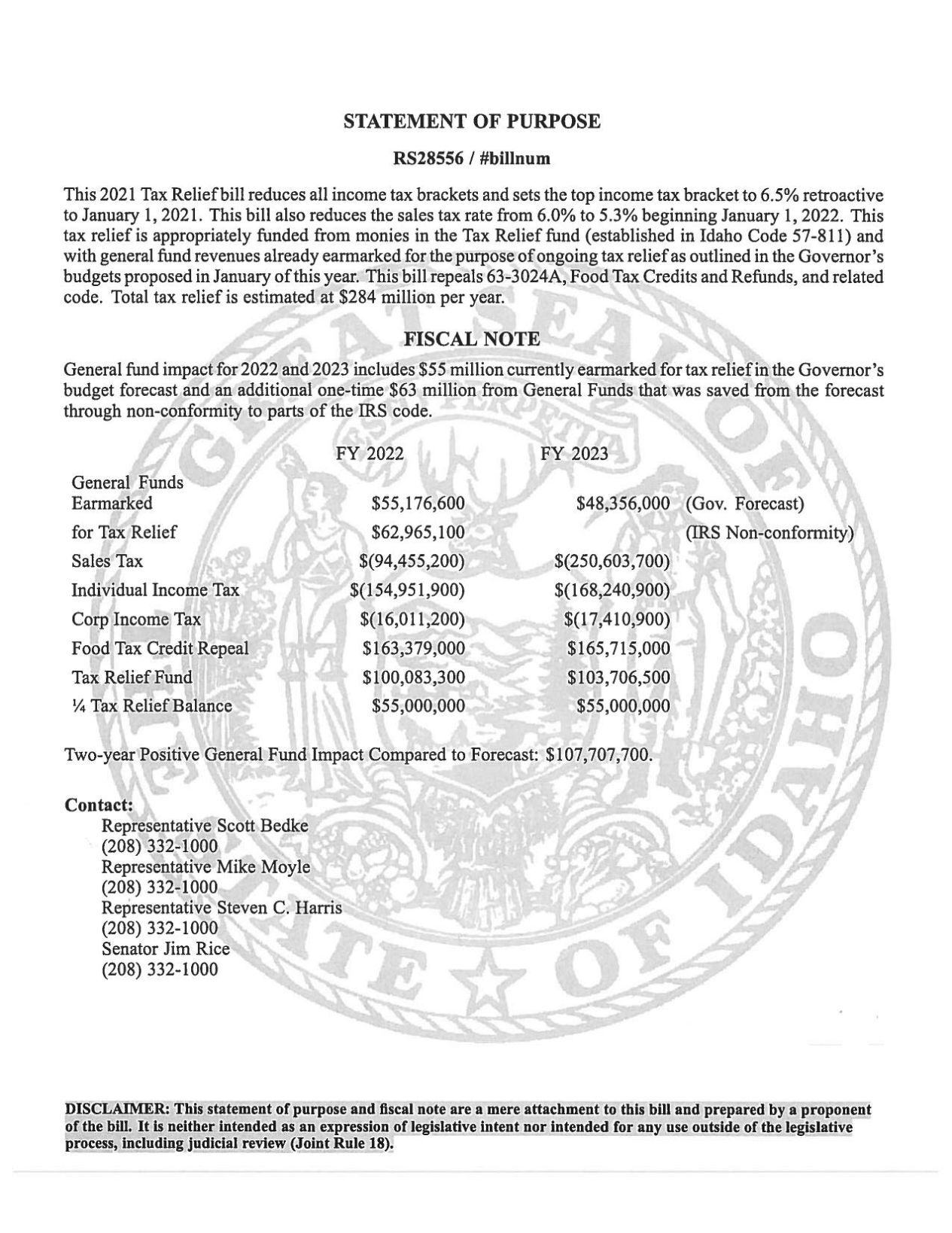

You can print a 6 sales tax table here. Idaho has enacted several tax cuts in the past decade lowering rates for top earners from a rate of 780 in 2011 down to the current rate of 650 for the 2021 tax year. The median property tax in Boise County Idaho is 1044 per year for a home worth the median value of 186700.

The average yearly property tax paid by Boise County residents amounts to about 189 of their yearly income. The 95 sales tax rate in Boise City consists of 45 Oklahoma state sales tax 2 Cimarron County sales tax and 3 Boise City tax. What is Idahos local sales tax rate.

This is how your levy rate is determined. Plus 5625 of the amount over. Idaho State Tax Commission.

Tax Rate. There is no applicable special tax. Sales or use tax is due on the sale lease rental transfer donation or use of a motor vehicle in Idaho unless a valid exemption applies.

The Idaho ID state sales tax rate is currently 6 ranking 16th-highest in the US. Pursuant to Idaho Code 63-1005 we will start the tax deed process in August 2021 with a letter advising owners that they have until January 31 st 2022 to pay. There are a total of 112 local tax jurisdictions across the state collecting an average local tax of 0074.

Plus 4625 of the amount over. Plus 1125 of the amount over.

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Idaho House Passes 600 Million Income Tax Cut And Tax Rebate Bill Idaho Capital Sun

Cell Phone Taxes And Fees 2021 Tax Foundation

U S States With Highest Gas Tax 2022 Statista

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

Did You Pay Idaho Use Tax Probably Not Stateimpact Idaho

Idaho S Grocery Sales Tax Is An Issue At Every Legislative Session Have Thoughts Let S Talk Idaho Capital Sun

State Income Tax Rates Highest Lowest 2021 Changes

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Sales Tax Rates In Major Cities Tax Data Tax Foundation

This Is The Most Expensive State In America According To Data Best Life

Rustic Acres 608 North Empress Street Mobile Home For Sale In Boise Id 1098574 Mobile Homes For Sale Mobile Home Rustic

Idaho Sales Tax Guide And Calculator 2022 Taxjar

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

Total Sales Tax Per Dollar By City Oklahoma Watch

Rep Harris Introduces Sweeping Tax Cut Bill Would Also Eliminate Grocery Tax Credit But Not Lift Sales Tax From Food Eye On Boise Idahopress Com